Managing Costs and Compliance in Self-Funded Plans

Managing a company health plan is one of the most significant responsibilities a business owner or HR leader faces. For many organizations, moving away from traditional insurance to a self-funded health insurance model is the most effective way to regain control over rising costs. However, running a health plan involves a mountain of complex tasks, from processing medical claims to ensuring ACA compliance.

This is where a Health Plan Third-Party Administrator (TPA) becomes a vital partner. By acting as the operational engine of your benefits package, a TPA allows you to focus on your core business while they handle the intricate details of healthcare administration.

What is a Health Plan Third-Party Administrator (TPA)?

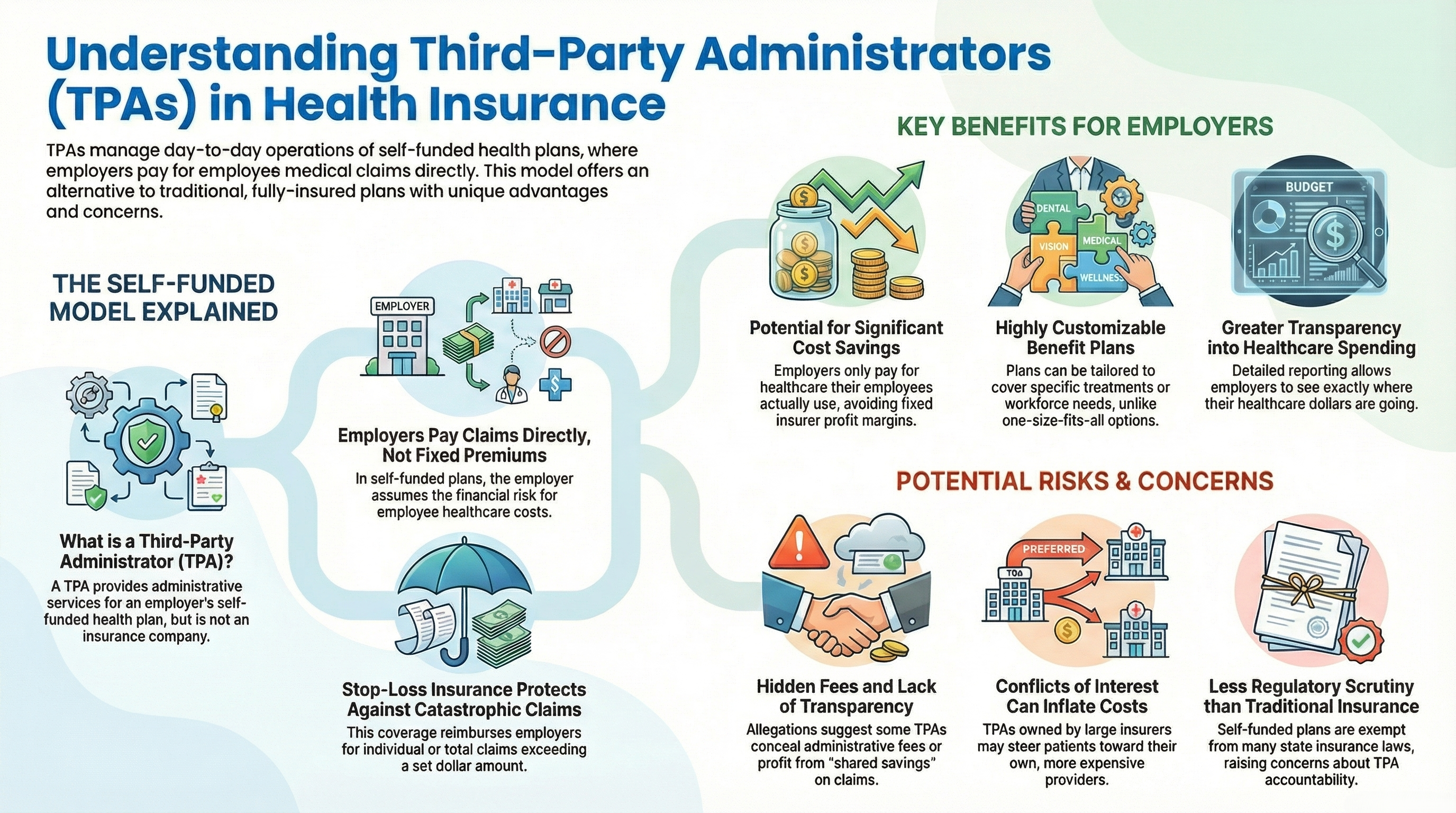

A Health Plan TPA is an independent organization that handles the day-to-day operations of a self-funded health insurance plan. They are hired by a plan sponsor (the employer) to process medical claims, manage open enrollment, and provide customer service to employees. Because they are not the insurance company itself, they offer a level of flexibility and transparency that is often missing in traditional "fully insured" arrangements.

TPA vs. Insurance Carrier: Who Bears the Risk?

In a fully insured plan, you pay a fixed premium to a carrier who takes on the financial risk. In a self-funded model managed by a TPA, the employer bears the risk. You pay the TPA a flat administrative fee, and then you pay for the actual healthcare services used. If your team stays healthy, your company keeps the savings.

The Mechanics of Self-Funding and the Role of TPAs

Self-funding allows you to work with a TPA to build a plan from the ground up, ensuring claims adjudication and utilization management run smoothly. This strategy helps companies avoid state premium taxes and gain total visibility into spending.

How Stop-Loss Insurance Protects Your Bottom Line

To prevent a single expensive hospital stay from impacting your budget, TPAs help you purchase stop-loss insurance:

- Specific Deductible: Protects against a single high claim from one individual.

- Aggregate Corridor: Protects the company if total group claims exceed a set limit.

Customizing Plan Design for Your Workforce

A TPA allows you to create a custom Summary Plan Description (SPD). You can choose your own PPO network, set prior authorization rules, and select a Pharmacy Benefit Manager (PBM) that fits your budget.

Core Services: From Claims Adjudication to Member Support

The core of TPA service includes claims adjudication—checking claims for accuracy—as well as streamlining open enrollment and eligibility tracking. They also manage provider reimbursement schedules and ensure network adequacy.

Advanced Claims Protection

A high-quality TPA catches errors through bill review before they are paid and handles overpayment recovery to return dollars to your plan.

Regulatory Compliance: Navigating ERISA, HIPAA, and the ACA

A TPA ensures your plan follows ERISA guidelines, HIPAA privacy requirements, and ACA compliance. From filing Form 5500s to managing COBRA notices, they keep you on the right side of the law.

The Transparency Challenge: Hidden Fees and Fiduciary Duty

A good TPA operates with a clear fiduciary duty. Under the Consolidated Appropriations Act (CAA), vendors must disclose all compensation to the plan sponsor to expose hidden kickbacks. A transparent TPA provides these disclosures proactively.

Protecting Your Plan from Hidden Fees

It is crucial to review your Administrative Service Agreement (ASA) for hidden spreads. Some TPAs engage in cross-plan offsetting or spread pricing in out-of-network negotiations, taking a percentage of savings as a fee. Transparent TPAs avoid these misaligned incentives, ensuring all shared savings remain with the plan.

The Summit Difference: A Legacy of Independence

Since 1996, Summit Administration Services has operated as a wholly independent TPA. We do not take fees, commissions, or spreads. Our structure includes:

- No Outside Influence: No investments from outside vendors or carriers.

- Conflict-Free Pricing: A clear PEPM fee outlined in our ASA.

- Zero Hidden Revenue: We do not profit from out-of-network percentage of savings models.

Contact Summit Administration Services

Ready to bring total transparency to your health plan? Let’s discuss how we can customize a program for your workforce.

Call us: 888-690-2020

Email us: mktgdept@summit-inc.net